The government of Pakistan issued a notification regarding the income tax rates for salaried prisons. According to the notification, the government decided to increase tax rates for employees. They going to increase the tax rate of salaried person employees along with the slab. Not only this, the government introduce the chart of the salaried person’s tax rates 2022-23. The chart of the tax rates for 2022 for employees is as under. For the ease of employees, we have mentioned the complete chart along with the slab. Take a look

Income Tax Rates 2022-23:-

Have a glance at the details income tax rates announced by the government for salaried persons. The details are as under.

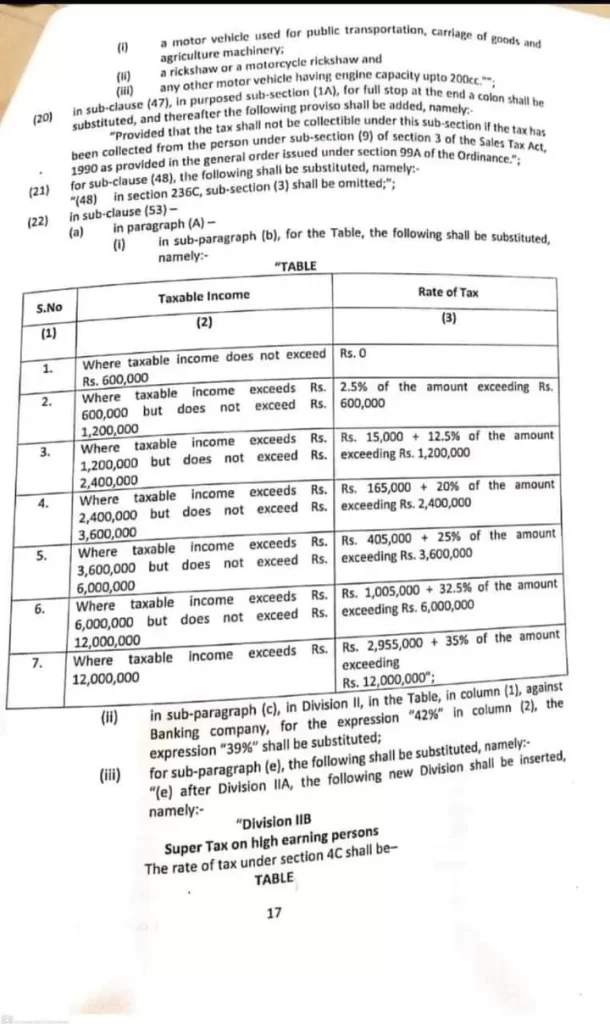

| S. No. | Taxable income | Rate of Tax |

| (1) | (2) | (3) |

| 1. | Where the taxable income does not exceed Rs.600,000 | Rs. 0 |

| 2. | Where the taxable income exceeds Rs.600,000 but does not exceed Rs.1,200,000 | 2.5% of the amount exceeding Rs.600,000 |

| 3. | Where taxable income exceeds Rs.1,200,000 but does not exceed Rs.2,400,000 | Rs.15,000 + 12.5% of the amount exceeding Rs.2,400,000 |

| 4. | Where taxable income exceed Rs.2,400,000 but does not exceed Rs.3,600,000 | Rs.165,000 + 20% of the amount exceeding Rs.2,400,000 |

| 5. | Where taxable income exceeds Rs.3,600,000 but does exceeds Rs.6,000,000 | Rs.1005,000 + 32.5% of the amount exceeding Rs.6,000,000 |

| 6. | Where the taxable income exceeds Rs.6,000,000 but does not exceed Rs.12,000,000 | Rs.2,955,000 + 35% of the amount exceeding Rs.12,000,000”; |

The above-mentioned charts clearly show that the tax rates for various slabs of employees decreased. For example, if we look at the 2nd slab of tax, the tax rates decreased from 5% to 2.5%. In previous years the tax rates for these employees were 5%. However, the slab extended. Previously the annual income for this slab started from 800,000/- per annual, now this slab starts from 600,000/- per annual. Employees whose monthly income is 50,001 will have to pay the income tax. You can check other slabs too for the calculation of your annual tax. The employees whose salary is Rs. 1 to 50,000/- will have to pay no tax.